Schedule A Itemized Deductions 2024 List – WealthUp Tip: Federal tax returns for the 2023 tax year are due April 15, 2024 (April take the standard deduction, you can’t claim any itemized deduction found on Schedule A. . With tax season underway, you’ll need to know the standard deduction amount you can claim for 2023. The standard deduction amounts tend to increase slightly each year to adjust for inflation. Let’s .

Schedule A Itemized Deductions 2024 List

Source : www.investopedia.comWho Should Itemize Deductions Under New Tax Plan | SmartAsset

Source : smartasset.comWhat Is Schedule A? | H&R Block

Source : www.hrblock.comMX3 Podcast

Source : www.facebook.comItemized deductions list: Fill out & sign online | DocHub

Source : www.dochub.comWhat Is Schedule A? | H&R Block

Source : www.hrblock.comWhat happened to Schedule C? — Quicken

Source : community.quicken.comResources Daniel Ahart Tax Service®

Source : www.danielahart.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comTax Deduction Definition: Standard or Itemized?

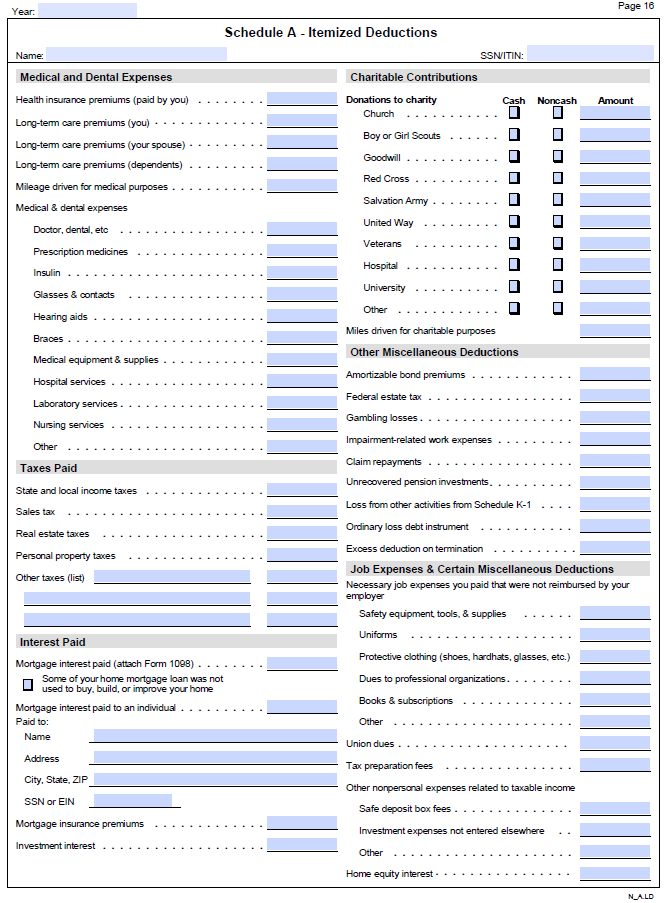

Source : www.investopedia.comSchedule A Itemized Deductions 2024 List All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: Here is a list of our partners and here’s how and dividends (1099-DIV), student loan interest (1098-E). Itemized deductions (Schedule A), deductions and expenses from freelance or self . The IRS’s Taxpayer Publication 502 dives into the itemized deductions possible for medical and dental expenses. The list includes generally be claimed on Schedule A (Form 1040). .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)