2024 1040 Schedule Class I To – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . To claim a loss from your small business, you must use Form 1040 as your individual income tax return form and Schedule C to demonstrate the loss. Complete “Part I” of Schedule C to determine .

2024 1040 Schedule Class I To

Source : thecollegeinvestor.comIRS Tax Forms CPE Courses | Learn with myCPE

Source : my-cpe.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comBGFS INC | Riverdale IL

Source : m.facebook.comIRS Delays Implementation of 1099 K Filing Changes to Calendar

Source : taxschool.illinois.eduJUST IN: The IRS has announced higher tax brackets for 2024

Source : www.reddit.com𝗥𝗲𝗽𝗿𝗲𝘀𝗲𝗻𝘁𝗶𝗻𝗴 𝗖𝗮𝗺𝗯𝗼𝗱𝗶𝗮.🇰🇭🌟 AFG OPEN Day 2

Source : www.instagram.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com2024 Important Tax Numbers: A Handy Guide | Financial Synergies

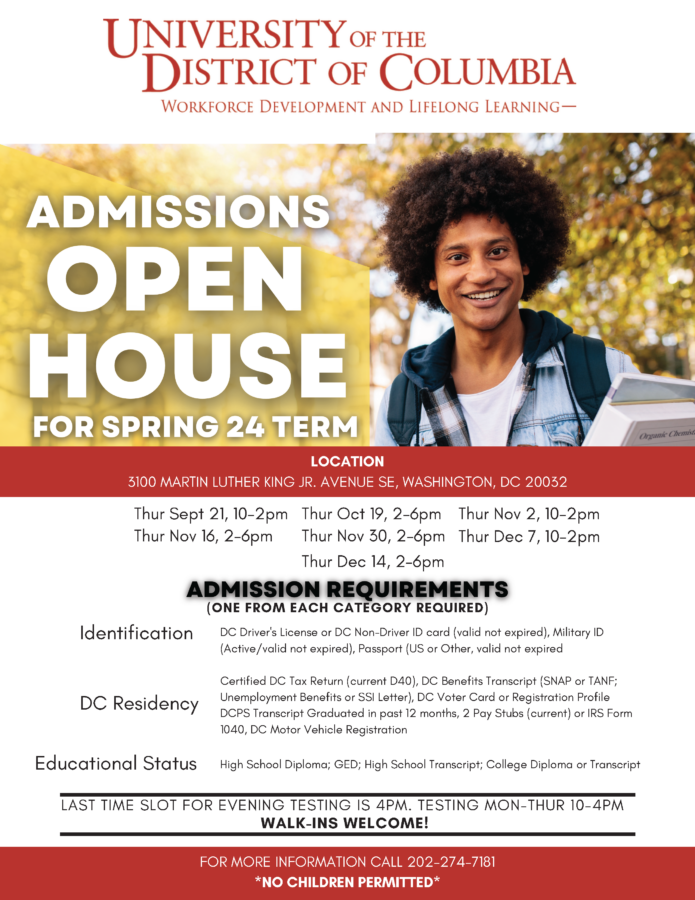

Source : www.finsyn.comHow to Apply and Enroll | University of the District of Columbia

Source : www.udc.edu2024 1040 Schedule Class I To When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: Prerequisite: Math 30; Phys 11A; Phys 11A may be taken concurrently *Click on the first column in each table row to see class details. Application of programming in the solution of practical . Now that you have your schedule for your first semester at Hope, you can learn how to read it, answer any questions you might have and find out how to request a change. On the first day of class, .

]]>